Why I started this

Experience

I started 20 years ago, buying my first share of Coca Cola because, well, that’s what you buy as your first share. I entrusted my life’s saving to my dad and he promptly lost it all in Nortel Shares during the hi-tech bubble. Then in 2007, I got into options. Boy was that the wrong time to get into options.

Both collapses were blessings in disguise, but only because I stuck with it throughout the turmoil . If I had lost all hope and did nothing, I’d be your typical slob with a dead end job everywhere. Instead, I now have a successful track record with 2 decades of investing and 7 years of options trading. I never wrote about it before because I never thought that I have enough experience compared to all the industry veterans. But after having survived this long (and after realizing that most of the pros have no idea what they are doing) I have enough data to say that yes, I know a bit more about it than your average chump. Learned several lessons on the way. The first and major one of which is :”Do not rely on others to manage your money.” Which means, if you are reading this, take everything I say with a grain of salt. In fact, take everything the professionals say with a bigger grain of salt and add vinegar to them while imagining yourself swimming in the sea with a huge cut.

Proof

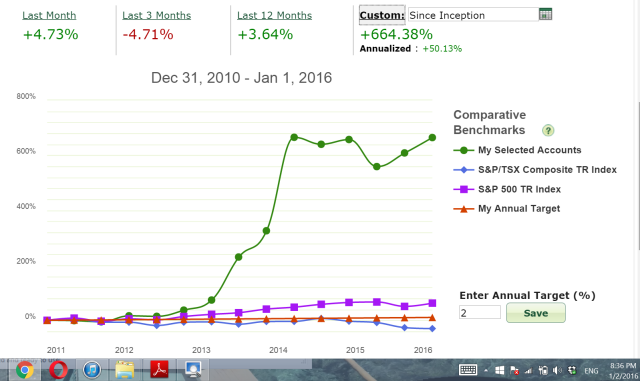

Enough talk. Because technology is finally advance enough that I can show concrete proof of my abilities, here is my performance from TD’s “Performance” tool. It takes into account when you inject money so as to not inflate your numbers. Also, since I am not the one making the report, there’s no way for me to cheat. TD customers will know that this is one of the standard reporting tools that they have on their brokerage account.

Keep in mind that this is in USD and I am a Canadian. At the moment I am writing this, USD to CAD is 1:1.4, so in CAD dollar term, it is even higher. The flat increase you see in the past 3 years is due to the fact that I’ve been travelling the world. Unfortunately, the reporting tool didn’t come out until 2011 and Mint didn’t come out until after 2008 for Canadians, you will have to trust me on my performance before 2011. (You can’t rely on mint’s reporting tools anyway)

Keep in mind that this is in USD and I am a Canadian. At the moment I am writing this, USD to CAD is 1:1.4, so in CAD dollar term, it is even higher. The flat increase you see in the past 3 years is due to the fact that I’ve been travelling the world. Unfortunately, the reporting tool didn’t come out until 2011 and Mint didn’t come out until after 2008 for Canadians, you will have to trust me on my performance before 2011. (You can’t rely on mint’s reporting tools anyway)

Past performance

There isn’t much to say about 2003. I lost all my life savings in Nortel. These includes money I earned cutting grass for neighbors, working during high school and through university and all the money I get in new years from grandparents. That, along with a useless engineering degree in 2003 marks the beginning of my foray into this strange world of finance. I realized at the beginning of my life, that hard work and intelligence means jack shit if you cannot see the major market trend in play. It is because of my ignorance and hatred of this side of society that saw me competing against 20 year engineering veterans for entry level jobs that requires 10 years experiences. You can say that my first 4 years of investment experience saw a net loss of infinity.

2007 I began my foray into options trading with a then unknown startup called “thinkorswim”. I don’t particularly have any preferences for Startups as I do not owe any favors to the startup industry (since none of them hired me). I just prefer to invest in companies that are very similar to startup in the $1~10 bil range that has the potential to go to $100 bil range. My first year of options trading coincided with the Great Recession and saw a loss of $30 000 of test money I put into my options account. I actually earned $10k at first, but then lost it all once the collapse infected other sectors of economy.

Professional background

My background is in weapons tech, imaging AI. But we didn’t have fancy names like that when I worked in the field. This one here is just the scope for your sniper rifle, that one there is the acquisition hardware for your missiles and here we have the iron dome missile identification software… Oh, is that one of the DARPA autonomous vehicle challenge team?

Decades of imagining what the AI should see, made me an expert of staring at graphs and making sense of hidden formations that doesn’t make sense.

Current life

I am juggling two hobbies and working on my startup at the moment. But I do have ideas from time to time about investments. Enough that I can probably post once per month, so that I have decided to gather them here. Life is hard, motivation is hard, but my passion for detective work in the financial world is like meditation. I need it. So here we are.

Leave a Reply